In this post, I’d like to discuss a staple concept of equity research - non-GAAP adjustments. Consider the following question:

A company has incurred a significant non-recurring expense which impacts comparability of its performance in FY23 with that of FY22. As an analyst, you’re required to normalize the FY23 results. How would the normalized net income (NI) and EBITDA compare with the reported NI and EBITDA?

Firstly, understand the nature of the non-recurring expense (or gain). It can be broadly categorized into three types:

Above-the-line items: Examples include restructuring, impairment, acquisition costs, store closure costs, litigation expenses, professional fees, amortization, inventory write-off, etc.

Below-the-line items: The most common adjustments are amortization of deferred financing costs, amortization of debt discount, early conversion costs on convertible notes, and tax impact of the non-GAAP adjustments.

Above-the-line items, although non-operational in nature, impact the EBIT and NI. For instance, consider an inventory write-off expense of $100m. Under GAAP rules, it is recorded as an expense within COGS. As part of non-GAAP adjustments, COGS would reduce by $100m to remove the impact of the write-off. As a result, gross profit, income before taxes, EBIT, and EBITDA would all be higher by $100m. Assuming the company’s effective tax rate at 20%, the non-GAAP tax expense would be higher by $20m and NI would increase by $80m. Most non-recurring above-the-line items are recorded as part of SG&A while some (such as restructuring or write-offs) are recorded as part of COGS. Understanding the account to which specific expenses are debited will help us evaluate which margins will be impacted after non-GAAP adjustments.

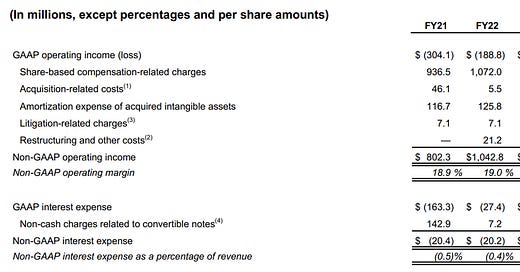

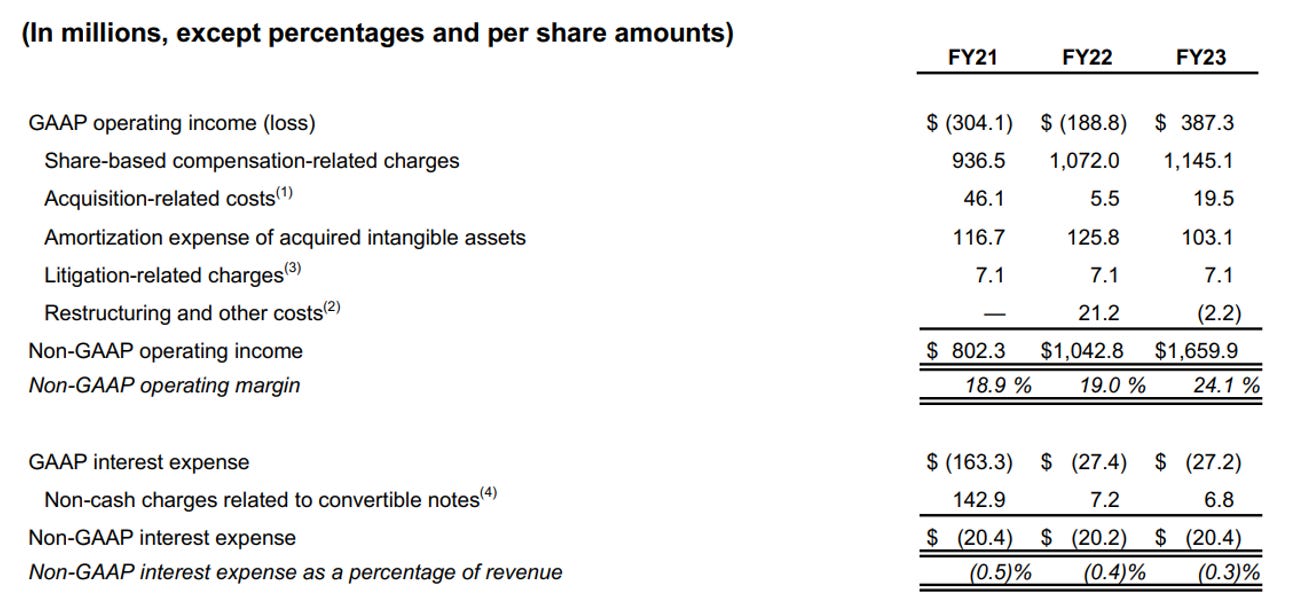

Below-the-line items impact the NI but not the EBIT. Consider the non-cash expense companies incur on convertible notes. They are included as part of the GAAP interest expense but do not reflect the true cost of the company’s debt. Removing the impact of the non-cash charge would lower the non-GAAP interest expense and increase the tax expense and NI (see below). An example of the two types of adjustments can be seen below in the results reported by Palo Alto Networks, Inc. (PANW)

Another important aspect of the below-the-line items is the tax impact of the adjustments. Adjusted EBIT excludes the gross value of all the one-time expenses and gains. The impact of such items on NI, however, is net of taxes. Hence, companies that typically report non-GAAP EBIT higher than GAAP EBIT will report a non-GAAP tax expense higher than the GAAP provision for taxes. An estimated statutory tax rate can be used to calculate the non-GAAP adjustments net of taxes. The non-GAAP effective tax rate is a more stable estimate of the company’s tax expense than the accrual provision reported under GAAP. The table below shows PANW’s effective tax rate at 22% for the three years from FY21-FY23 while the GAAP tax rate wildly fluctuated.

The total gross value of all the adjustments to arrive at non-GAAP PBT in FY23 was $1,279.9m. As a result of the adjustments, income tax expense increased by $279.6m, translating to ~22% effective tax rate on the adjustments. The impact of the adjustments on NI is:

Non GAAP NI = GAAP NI + [(gross value of adjustments * (1-effective tax rate)]

In PANW’s example, for FY23, $1,440m = $439.7m + [($1,279m * (1 - 0.2185)]

To understand the impact of non-GAAP adjustments on EBITDA, let’s look at the 2Q24 results of the RV retailer, Camping World Holdings, Inc. (CWH)

During the quarter, CWH reported $87.5m in EBITDA calculated as group net income plus interest expense on debt, taxes, and depreciation and amortization (D&A). Note that floor plan interest cost, a type of inventory financing expense for retailers, is usually excluded from EBITDA since it is an operational expense. Non-GAAP results exclude the impact of non-recurring expenses worth $18.0m in total, gross of taxes. These adjustments resulted in a like-for-like dollar increase in EBIT, income before taxes, and EBITDA. Non-GAAP adjustments lead to a gross dollar increase in EBITDA, which represents profit earned before interest, taxes, and D&A. Hence, the tax impact of the adjustments does not change EBITDA. The impact on net income, which increased by $7.2m, is a function of the tax impact of the adjustments and the marginal NI attributable to non-controlling interest (NCI).

Summary

Non-GAAP adjustments can be complex and sometimes misleading. Most companies are prudent in classifying an expense as non-recurring. Nevertheless, investors should understand the nature of the expenses before accepting the reported non-GAAP results. For instance, it is unreasonable to exclude stock-based compensation (SBC) in non-GAAP results for companies that regularly pay out in equity to their employees, a practice widely prevalent in the tech industry. SBC is very much an operational expense that the company must spend to attract and retain talent. More examples of how companies can get creative with non-GAAP measures can be found here. Reading between the lines of non-GAAP results is essential to arrive at the intrinsic value for companies as most valuation metrics are based on adjusted results intended to represent the business’ ability to generate recurring profits.